Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Hidden Fees to Be Aware of When Purchasing a Home

Purchasing a home is arguably one of the biggest financial decisions you will make in your lifetime. As you start your hunt, don’t forget there will be other costs associated with your purchase then the price of the home. Here are 5 fees to keep in mind as you begin to budget.

- Home inspection. This is a crucial step in the home buying process. The findings that come from the inspection can help you negotiate price and repairs. Generally, you can expect to pay between $300 to $500 depending on the home and the location.

- Title services. Title services encompass the transfer of the title from the seller and a thorough search of the property’s records to ensure to no one will pop up with a claim to the property. Additionally, you may need to buy title insurance which will protect the lender or your investment in the home.

- Appraisal fee. Before getting a loan, you will likely be required to get an appraisal of the home to determine its estimated value. This will be conducted by a third-party company and the cost can land anywhere between $300 and $1,000, depending on the size of the home.

- HOA fees. Many communities have a homeowners’ association that enforces monthly fees. This money is used for general maintenance and updates to areas like pools, parks, and more. Typical HOA fees are around $200 per month.

- Taxes. The taxes each buyer pays at the closing table differ, but it is not uncommon for it to be up to two months’ worth of county and city property taxes. Additionally, there may be taxes for the transfer of the home title.

How to Get Ready for Retirement

For most people, retirement feels like a long way off. But, if you don’t start preparing as early as possible, you may find yourself in a place of financial insecurity when the time does come. To avoid this, consider implementing the following tips.

- Calculate your target savings. In general, it’s recommended that you save between 10 to 15 percent of your income for retirement. However, you can always use an online savings calculator to determine the amount you need to save for your specific needs and goals.

- Contribute to your employer’s retirement savings plan. Does your job offer a 401(k), traditional IRA, or Roth IRA? Sign up and start saving as soon as they allow you to. It’s recommended to set up automatic paycheck deductions and, once the money is in your retirement fund, don’t touch it.

- Take advantage of employee benefits. Many employers offer matching which generally requires you contribute a certain percentage of each paycheck and your company will then contribute a matching amount with funds of their own. They might also offer health savings or flexible savings account. By contributing to these accounts, you reduce your amount of taxable income, allowing you to save more money.

- Pay off your debts. Start by paying off any high-interest credit card debt first. Then look at other debts, such as student loans and car payments, and make a plan for paying those off incrementally.

- Reduce daily spending. Although this feels like a no-brainer, spending your money thoughtfully now can make a big impact later. Seek out areas of your life where you can

Should You Still Buy a Home with the Latest News About Inflation?

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession.

You’re likely feeling the impact in your day-to-day life as you watch the cost of goods and services climb. The pinch it’s creating on your wallet and the looming economic uncertainty may leave you wondering: “should I still buy a home right now?” If that question is top of mind for you, here’s what you need to know.

Homeownership Is Historically a Great Hedge Against Inflation

In an inflationary economy, prices rise across the board. Historically, homeownership is a great hedge against those rising costs because you can lock in what’s likely your largest monthly payment (your mortgage) for the duration of your loan. That helps stabilize some of your monthly expenses. James Royal, Senior Wealth Management Reporter at Bankrate, explains:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

And with rents being as high as they are, the ability to stabilize your monthly payments and protect yourself from future rent hikes may be even more important. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains what happened to rents in the latest inflation report:

“Inflation refuses to budge. In September, consumer prices rose by 8.2%. Rents rose by 7.2%, the highest pace in 40 years.”

When you rent, your monthly payment is determined by your lease, which typically renews on an annual basis. With inflation high, your landlord may be more likely to increase your payments to offset the impact of inflation. That may be part of the reason why a survey from realtor.com shows 72% of landlords said they plan to raise the rent on one or more of their properties in the next year.

Becoming a homeowner, if you’re ready and able to do so, can provide lasting stability and a reliable shelter in times of economic uncertainty.

Bottom Line

The best hedge against inflation is a fixed housing cost. If you’re ready to learn more and start your journey to homeownership, let’s connect.

The Latest on Supply and Demand in Housing

Over the past two years, the substantial imbalance of low housing supply and high buyer demand pushed home sales and buyer competition to new heights. But this year, things are shifting as supply and demand reach an inflection point.

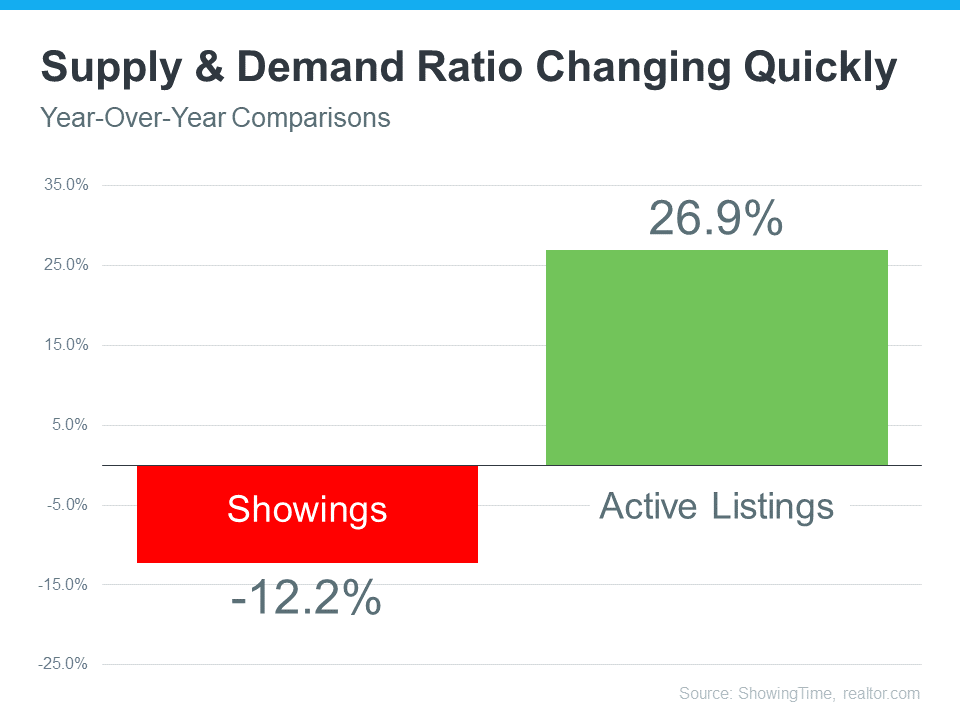

The graph below helps tell the story of just how different things are today.

This year, buyer demand has eased as higher mortgage rates and mounting economic uncertainty moderated the market. This slowdown in demand is clear when you look at the red bar on the graph. It uses the latest data from ShowingTime to illustrate how showings (an indicator of buyer demand) have softened by just over 12% compared to the same time last year.

Now for a look at how housing supply has changed, turn to the green bar. It uses data from realtor.com to show active listings are up nearly 27% compared to last year. That’s because the moderation of demand allowed housing inventory to increase in 2022.

What Does This Inflection Point Mean for Buyers?

If you’re thinking of buying a home, you’ll have less competition and more options than you would have had last year. Enjoy having more homes to choose from in your home search and lean on a trusted real estate professional to understand how the increase in supply has also increased your negotiation power. That professional can talk you through the opportunities and challenges buyers face in today’s shifting market. You may be surprised to find they’re different than they were a year ago.

What Does This Inflection Point Mean for Sellers?

If you’re looking to sell your house, know that inventory is still low overall. That means, if you work with an agent to price your house based on current market value, it will still sell despite the inventory gains and moderating buyer demand this year. That’s because there are still buyers out there who want to move, and your house may be exactly what they’re looking for.

Bottom Line

If you’re thinking of buying or selling a home, the best place to turn to for information on today’s supply and demand is a trusted real estate professional. Let’s connect so you know what’s happening in our local market and what that means for you.

The Emotional and Non-financial Benefits of Homeownership

With higher mortgage rates, you might be wondering if now’s the best time to buy a home. While the financial aspects are important to consider, there are also powerful non-financial reasons it may make sense to make a move. Here are just a few of the benefits that come with homeownership.

Homeowners Can Make Their Home Truly Their Own

Owning your home gives you a significant sense of accomplishment because it’s a space you can customize to your heart’s desire. That can bring you added happiness.

In fact, a report from the National Association of Realtors (NAR) shows making updates or remodeling your home can help you feel more at ease and comfortable in your living space. NAR measures this with a Joy Score that indicates how much happiness specific home upgrades bring. According to NAR:

“There were numerous interior projects that received a perfect Joy Score of 10: paint entire interior of home, paint one room of home, add a new home office, hardwood flooring refinish, new wood flooring, closet renovation, insulation upgrade, and attic conversion to living area.”

And as a homeowner, unless there are specific homeowner’s association requirements, you typically won’t have to worry about the changes you can and can’t make.

If you rent, you may not have the same freedom. And if you do make changes as a renter, there’s a good chance you’ll need to revert them back at the end of your lease based on your rental agreement. That can add additional costs when you move out.

The Responsibilities of Homeownership Give You a Greater Sense of Achievement

There’s no denying taking care of your home is a large responsibility, but it’s one you’ll take pride in as a homeowner. Freddie Mac explains:

“As the homeowner, you have the freedom to adopt a pet, paint the walls any color you choose, renovate your kitchen, and more. . . . Of course, along with the freedoms of homeownership come responsibilities, such as making your monthly mortgage payments on time and maintaining your home. But as the property owner, you’ll be caring for your own investment.”

You’re not taking care of a living space that belongs to someone else. The space is yours. As an added benefit, you may get a return on investment for any upgrades or repairs you make.

Homeownership Can Lead to Greater Community Engagement

That sense of ownership and your feelings of responsibility can even extend beyond the walls of your home. Your home also gives you a stake in your community. Because the average homeowner stays in their home for longer than just a few years, that can lead to having a stronger connection to your local area. NAR notes how that can benefit you:

“Living in one place for a longer amount of time creates an obvious sense of community pride, which may lead to more investment in said community.”

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you.

Bottom Line

If you’re planning to buy a home this year, there are incredible benefits waiting for you at the end of your journey, including the ability to customize your home, the sense of achievement homeownership brings, and a greater connection to your community. Let’s connect to discuss everything homeownership has to offer.

Are Zillow Estimates Accurate? The Inside Scoop

The Truth on Zillow Estimate

When searching homes online, you might be swayed by some of the home value estimates you see. But the information on most websites can be misleading. If you’re a home buyer looking to get a quick glimpse of accuracy, Zillow can be a great place to start.

A few years ago, Zillow used to base its estimates on quantitative data like the number of bedrooms, year built, and square footage. These days, they have made some improvements to their algorithm.

So, what is a Zillow estimate, and now accurate are they? We answer this question and more below.

What is a Zillow estimate?

A Zillow estimate is an automated home valuation tool that provides an estimate of a home’s market value. Also called a Zestimate, it’s based on public and user-submitted data, and incorporates home facts, location and market conditions.

Zillow was founded in 2006, and the site is mainly for browsing homes for sale before choosing an agent. Most Realtors get homes listed on Zillow, as it’s a popular site that gets a lot of traffic from buyers and sellers. However, Zillow isn’t really known or recommended for finding agents and home loans.

How is a Zillow estimate calculated?

To calculate an estimate, Zillow uses proprietary algorithms that incorporate data from brokerages and multiple listing services. Additionally, it includes features like the number of bathrooms, location, square footage, etc.

To ensure you get an accurate estimate, they include details like listing price of comparable data, tax assessments, and prior sales records.

How accurate is a Zillow estimate?

The accuracy of Zestimate depends on data of specific area and location. It works well on listed properties because the price is already accounted for. However, they may not be accurate when it comes to off-market homes.

Admittedly, a Zillow estimate doesn’t take into account the recent upgrades or any structural issues. It’s also very difficult for the algorithm to tell the difference between a painted floor and another one that is fully furnished. This is true for any online valuation tool such as Redfin or Realtor.com.

The good thing though is that Zillow never claims to be 100% accurate. The tool has an accuracy of about 80% in all areas. This is because there are no specific variances to throw it off.

However, in some home value estimate cases (especially in older neighborhoods), the Zillow estimate won’t be close at all.

Is a Zestimate high or low?

For larger markets, the median error is about 2% of home value. The amount of data you have for a specific home will determine the accuracy of a Zillow estimate. If the information is inaccurate or incomplete, it will affect the Zestimate.

When a new home gets into the market, the data will change. This is because on-market homes incorporate valuable data that may not include eventual sales price.

The estimate can also be far off, especially if it has been listed for much longer. Similarly, if you change some home facts, Zestimate can change. But if the update is not significant enough, the estimate may not change. And on rare occasions, the schedule may be changed by new analytical features.

Many other things can affect Zestimate. For instance, the historical data cannot affect the future prices of a house. And when there are major updates on an algorithm, the estimate may not be accurate.

Since Zestimate includes data available for a home, any outdated information may lead to an inaccurate estimate. Information like heat source, building amenities, architectural style, and more can change the value of the home. This is especially true if these factors are inaccurate.

Other things to consider

Zestimates also won’t help you factor in things like commission rates. Real estate agent commission is typically split 50/50 between the agents who represent the buyer and seller. So, out of a gross 6% commission, your agent would only typically get 3% gross.

Out of that 3%, the agent has to split with their office. This generally ranges from a 50/50 to as high as a 90/10 split. So, on average the actual agent may only get 1.5% of that 6% commission.

Remember, everything is negotiable in real estate. Don’t discount using a Realtor because you think you must pay 6% to 10% in commissions. Agents may negotiate lower rates depending on the type of transaction, the services required, and frequency of business.

For example, if you are a real estate investor selling and buying 10 homes a month, an agent might be willing to work a 50% off deal in exchange for the volume. If they are receiving a referral from a trusted source they may offer a modest discount, while still giving a full-service experience. If you don’t need the agent to host open houses, and they can secure a buyer directly, without having to split with another agent, then they may offer a discount relative to their savings.

Home sellers may also work with their agents on bonuses and incentives. These may be paid by the seller, or out of the listing agent’s commission. For example, offering a $10,000 bonus for a full price offer which closes within 30 days, or contributing 3% of the purchase price toward buyer’s closing costs.

Zestimates VS. Appraisals

Let’s be clear: a Zillow estimate is not an appraisal. It’s a computer-generated estimate based on the available data. While many home buyers will consider Zestimate when looking for a home, they should also factor in a professional real estate estimate.

Zestimate shouldn’t be used in place of an appraisal, but it’s a good starting point when buying a home. And because it depends on the data of a specific area, it can include the number of bathrooms, bedrooms, and square footage.

This brings us to the question, does Zestimate differ from the actual home price? There’s always a slight variation. For instance, Zillow estimated a home at Midtown Sacramento at $380,000, but the actual price was $349,000. This showed the estimate was off the target by about 9%.

While most Zillow estimates are off target by a small margin, they can be helpful when giving a price range. But they should not replace a professional real estate opinion. That’s why it’s important to partner with an experienced Realtor when you’re ready to sell your home.

Aside from getting your home in front of the most qualified and best fitting home buyers, the most influential factor in getting a home sold and how fast it sells is the asking price.

Price it just a little too high and your home listing will be ignored. Of course, you don’t want to sell yourself short either. That’s why Realtors are indispensable.

How to Check a Zillow Estimate

If you want to know the fair market value of a property, a Zestimate has you covered. The value will determine your investment strength and home’s equity.

To use Zillow Estimate, log in to the website and key in important data. And because there’s no guesswork here, they use tons of data and sophisticated algorithms.

The estimating method does comparative analysis from similar neighborhoods. It also extrapolates sales from similar markets. Also, the algorithm uses larger data that exceeds that of your neighborhood of interest. Even if there are no recent sales, the algorithm will identify trends in the local housing market.

Can you review the Zestimate if there are some errors?

Zillow doesn’t delete Zestimate. If you believe a home doesn’t have enough data, you can review for any possible data. Moreover, you can provide additional information like lot size, tax details, beds, baths, etc. Your goal is to get a neutral estimate that is not far from the fair market value.

Does Zillow’s algorithm include foreclosures?

Zillow doesn’t incorporate foreclosure sales. It gives the value a property would fetch but doesn’t cover foreclosure resale transactions. Because the value is calculated by automated software, you can’t alter the values. Keep in mind the valuations are not used by lenders to estimate the value of the property.

Should real estate professionals rely on a Zillow estimate?

While Zestimate doesn’t give an accurate price, it’s a good starting point for home buyers. A home listed on Zillow will often give the first impression to buyers. When you combine Zillow’s estimates with information from real estate professionals, you can make an informed decision for your dream home.

It’s not a good idea to solely rely on a Zillow estimate as an appraisal tool. However, the site is a good starting point for buying a home. Be sure to supplement Zestimate with comparative market analysis or a professional appraisal for a home.

Above all, remember that your realtor should be there to aid in your home buying process, not just to show you listings. Helping you avoid the wrong time to buy, the wrong location or the wrong house for your budget can all go a long, long way in making sure that you’re happy with the end result. Beyond that, realtors aren’t all the same, and you will need to find one that gels with your interest as a home buyer before choosing to go the length of the field with them.

by Cody Tromler

Easy Landscaping DIY Projects

Ever get the itch to do a DIY project? Whenever we do, our favorites involve getting outdoors and mixing up our landscaping features.

Whether it’s as simple as installing some lighting or a little more time-consuming like re-plotting plants, a fresh look for the lawn always gives your home a fresh look as well. Here are our top five easy landscaping projects!

Create a pathway.

To guide you and visitors throughout your yard and link different areas together, install a pathway. You can use materials from a variety of materials, including reclaimed pallet wood, flagstones, gravel, and more to add texture and color.

Add a wall or border.

Installing a flagstone, rock, or brick wall around flower beds or trees adds a sleek, clean look to your landscaping and helps separate different sections of your yard.

Install a water feature.

Nothing says zen quite like the sound of trickling water as you relax in your backyard. You can start simple with by purchasing and installing a small feature powered by a solar panel or create a larger focal point in your yard by installing a waterfall wall or small pond.

Light your way.

An easy way to transform your yard is to strategically use lighting. Place cool-colored lights high in trees to recreate a moonlight feel, use pathway lights to naturally guide the eye, or highlight objects or plants.

Plant upwards.

Expand your yard space by drawing the eye to the sky with a trellis fence or screen made of wood or metal. Once you install your trellis, select your climbing plants and vines and get to planting!

Dispelling Refinancing Myths

“Refinancing” is a scary word for many people, but that shouldn’t be the case for you. For many homeowners, refinancing can not only lower your monthly payments and help with your monthly budget, but it can save you thousands of dollars in the long run.

YOU’RE NOT TOO LATE.

For years now, we’ve been hearing that interest rates will be on the rise, and although there have been some small increases, you’re still in a great position to drastically lower your interest rate. The general rule is if your mortgage interest rate is more than one percent above the current market rate, you should consider refinancing.

IT’S NOT TOO TIME CONSUMING.

Don’t brush off refinancing just because it seems like a long and daunting process. An informational call with a lender to see how rates compare will only take a few minutes. There are also some programs for streamlining the application process. And besides, isn’t the amount of money you could save worth the time and effort?

ARMS CAN BE REFINANCED, TOO.

Seeing your Adjustable Rate Mortgage (ARM) increase after the introductory period can be incredibly stressful and place a squeeze on your budget. Many people assume they’re stuck, but ARMs can be refinanced, just like fixed-rate mortgages. You can even switch to a shorter term fixed-rate mortgage, such as 15 or 23 years. The longer you’re planning to stay in the home, the more sense it makes to look into refinancing.

Create the Home Office of Your Dreams

Whether you work full-time at home or occasionally need to conduct business in the evenings or on the weekends, a home office a great way to utilize an extra room. A dedicated workspace in your home can be designed to increase productivity and comfort. Here are 5 ideas to get you started.

- Invest in a good office chair. Investing in an ergonomic office chair is essential. You may be spending anywhere from 30 to 50 hours a week sitting in it, so your back will thank you. Purchasing one with multiple adjustments is ideal so it fits you just right.

- Switch up your lighting. Fluorescent lighting has been proven to be hard on the eyes. Make the switch to LED or halogen light bulbs in your home office and try to let in as much natural light as possible. Also, consider finding a desk lamp to reduce headaches and eye strain.

- Keep essentials in reach and organized. Nothing says productivity like a clean, neat workspace. Select a desk with a lot of storage or install creative shelving to keep items like pens, pencils, extra batteries, calculators, notepads, and more stored within arm’s reach.

- Decorate bright. Pick a color you love and use it to spice up the room. Use cheery yellow or red or relaxing tones like green and blue, instead of beiges and browns.

- Aim for the view. If possible, place your desk so you are facing a window instead of a blank wall. Natural light can do wonders for staying alert and you can give yourself a short mental break when necessary by looking to the outdoors.

Create an Evacuation Plan for Your Pets

An evacuation plan is a necessity for every home, especially if you live in an area where fires, earthquakes, hurricanes, flooding, and other disasters are a possibility. Many homeowners create evacuation plans for their homes and practice them with their kids, but far fewer have considered one for their pets. Take these steps to add your pets to your evacuation plan.

Assign pet evacuation to an adult. Everyone should know how to act during an evacuation, and that includes assigning one parent or adult to the pets. This allows the other parent and the children to focus on their part of the evacuation plan, so there’s no confusion during a high-stress moment when time is of the essence.

Keep evacuation maps and pet carriers readily accessible. If you need to evacuate, you should know exactly where every important item is. If you pets require carriers, keep them in a place that you can access easily.

Practice your plan. Include your pets in your home evacuation drills. It’ll help you see how they will respond and make changes to your plan if necessary. Getting your dog out of a window may not be as simple as you think!

Be prepared in case you get separated from your pets. No matter how much you drill your evacuation plan, it’s possible that a dog or cat will run off while you’re focusing on keeping your family safe. A microchip or a GPS-compatible tag can help you find your pets once it’s safe to return to the area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link