Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

3 Reasons Why We’re Not Headed for a Housing Crash

Back in 2008, there was an oversupply of homes for sale. Today, there’s an undersupply. The three main sources of inventory show this isn’t like the last time. Existing homes, new homes, and foreclosures are all way below the levels we saw during the housing crash. Inventory data shows there just aren’t enough homes available to have a repeat of what happened back in 2008.

Why the Sandwich Generation Is Buying Multi-Generational Homes

Are you a part of the Sandwich Generation? According to Realtor.com, that’s a name for the roughly one in six Americans who take care of their children and their parents or grandparents at the same time.

If that sounds familiar to you, juggling all the responsibilities involved certainly must have its challenges. But it turns out there’s one pretty significant benefit: it can actually make it a bit easier for you to buy a home.

How Can It Help You Buy a Home?

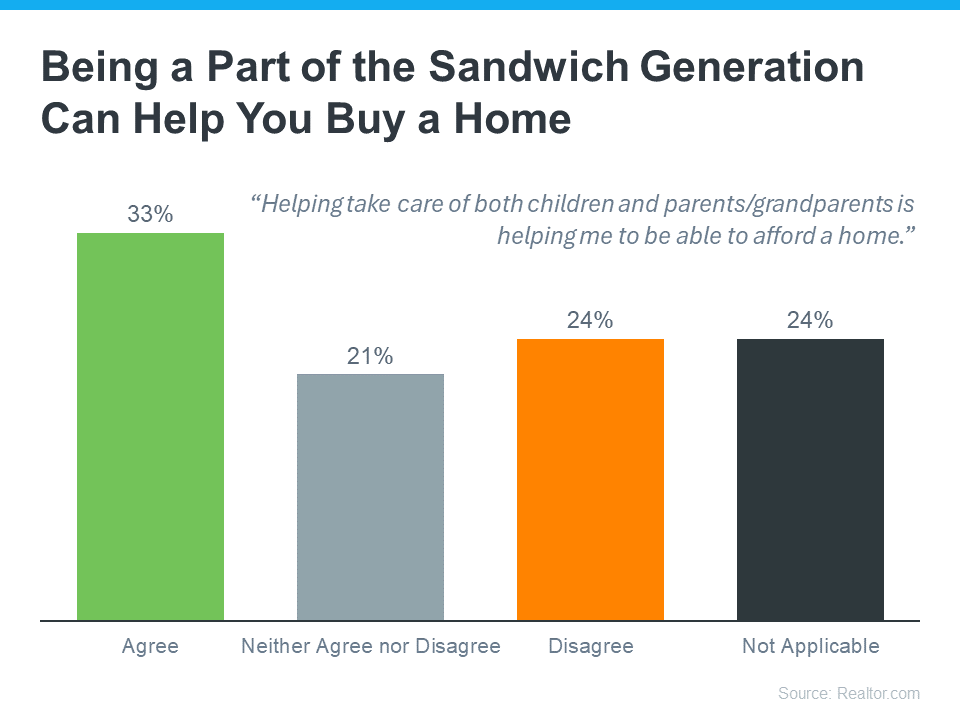

Realtor.com asked members of the Sandwich Generation if they agree or disagree that taking care of children and parents at the same time is helping them afford a home. A third of respondents said their situation made it easier to buy (see graph below):

Here are a few ways their caretaking situation might be helping those 33% buy a home:

Here are a few ways their caretaking situation might be helping those 33% buy a home:

- Sharing Expenses: If you live in a multi-generational household, you can pool your resources and split the costs. Your parents might contribute to the mortgage or help with other bills. This can make a big difference, especially in today’s housing market. It may help you afford a larger home than you could on your own.

- Built-In Childcare: Having grandparents in the home could also save you money on childcare. They can help watch your kids while you’re at work, which means you can save on daycare costs too.

Beyond just the financial reasons, buying a multi-generational home has other advantages. The Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) highlights some of the most popular, including:

- Easier To Care for Aging Parents: It’s more convenient to take care of someone when you live with them. Also, your elderly parents may very well be happier and healthier, thanks to more social interaction and a feeling of connectedness.

- Spending More Time Together: Once you live together, you get to spend more time and create even more lasting memories with your loved ones.

The Mortgage Reports sums it up this way:

“Buying a house with your parents can be a great way to ease caregiving, support young children, or simply bring loved ones closer together. And considering the steep rise in home prices over the last few years, it can make homeownership a lot more affordable.”

How a Real Estate Agent Can Help

If you’re in the Sandwich Generation and thinking about buying a multi-generational home, working with a local real estate agent is essential. Finding a home that works for so many people can be tricky. An agent will use their expertise to help you find one that meets the needs of, and has enough space for, everyone who’s going to live there.

Bottom Line

Being a part of the Sandwich Generation comes with its challenges – but it also might come with one truly great perk. If you’re looking to buy a home, your caregiving situation can actually make it a bit easier for you to afford a home. To learn more, let’s connect.

Should You Rent Out or Sell Your House?

Figuring out what to do with your house when you’re ready to move can be a big decision. Should you sell it and use the money for your next adventure, or keep it as a rental to build long-term wealth?

It’s a question many homeowners face, and the answer isn’t always straightforward. Whether you’re curious about the potential income from renting or worried about the responsibilities of being a landlord, there’s a lot to consider.

Let’s walk through some key questions to ask to help you make the best decision for your situation.

Is Your House a Good Fit for Renting?

Even if you’re interested in becoming a landlord, your current house might not be ideal for renting. Maybe you’re moving far away, so keeping up with the ongoing maintenance would be a hassle, the neighborhood isn’t great for rentals, or the house needs significant repairs before you could rent it out.

If any of this sounds like it might apply, selling might be your best option.

Are You Ready for the Realities of Being a Landlord?

Managing a rental property isn’t just about collecting rent checks. It’s a time-consuming and sometimes challenging job.

For example, you may get calls from tenants at all hours of the day with maintenance requests. Or you may find a tenant causes damage you have to repair before the next lease starts. You may even have to deal with people falling behind on payments or breaking their lease early. Investopedia highlights:

“It isn’t difficult to find horror stories of landlords troubled with more headaches than profits. Before deciding to rent, consider talking to other landlords and doing a detailed cost analysis. You might find that selling your home is a better financial decision and less stressful.”

Do You Have a Good Understanding of What It’ll Cost?

If you’re thinking about renting out your home primarily to generate extra income, remember that there are additional costs you’ll want to plan for. As an article from Bankrate explains:

- Mortgage and Property Taxes: You still need to pay these expenses, even if the rent doesn’t cover all of it.

- Insurance: Landlord insurance costs about 25% more than regular home insurance, and it’s necessary to cover damages and injuries.

- Maintenance and Repairs: Plan to spend at least 1% of the home’s value annually, more if the home is older.

- Finding a Tenant: This involves advertising costs and potentially paying for background checks.

- Vacancies: If the property sits empty between tenants, you’ll lose rental income.

- Management and HOA Fees: A property manager can ease the burden, but typically charges about 10% of the rent. HOA fees are an additional cost too, if applicable.

Bottom Line

To sum it all up, selling or renting out your home is a personal decision that depends on your circumstances. Whatever you decide, taking the time to evaluate your options will help you make the best choice for your future.

Make sure to weigh the pros and cons carefully and consult with professionals so you feel supported and informed as you make your decision. That’s what we’re here for.

3 Reasons Why We’re Not Headed for a Housing Crash

Back in 2008, there was an oversupply of homes for sale. Today, there’s an undersupply. The three main sources of inventory show this isn’t like the last time. Existing homes, new homes, and foreclosures are all way below the levels we saw during the housing crash. Inventory data shows there just aren’t enough homes available to have a repeat of what happened back in 2008.

Why the Sandwich Generation Is Buying Multi-Generational Homes

Are you a part of the Sandwich Generation? According to Realtor.com, that’s a name for the roughly one in six Americans who take care of their children and their parents or grandparents at the same time.

If that sounds familiar to you, juggling all the responsibilities involved certainly must have its challenges. But it turns out there’s one pretty significant benefit: it can actually make it a bit easier for you to buy a home.

How Can It Help You Buy a Home?

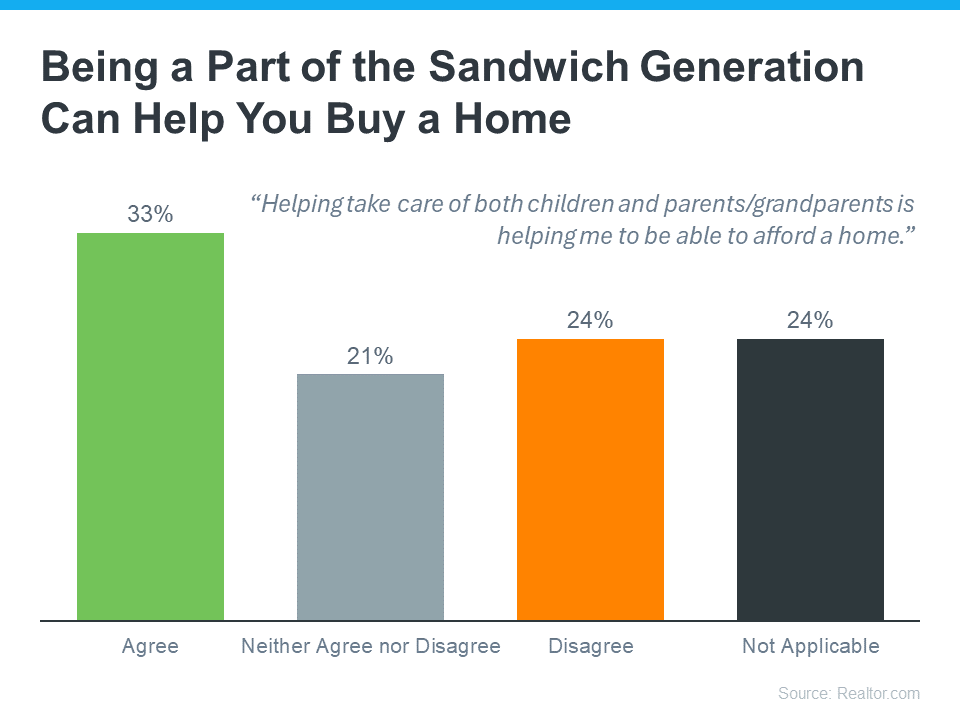

Realtor.com asked members of the Sandwich Generation if they agree or disagree that taking care of children and parents at the same time is helping them afford a home. A third of respondents said their situation made it easier to buy (see graph below):

Here are a few ways their caretaking situation might be helping those 33% buy a home:

Here are a few ways their caretaking situation might be helping those 33% buy a home:

- Sharing Expenses: If you live in a multi-generational household, you can pool your resources and split the costs. Your parents might contribute to the mortgage or help with other bills. This can make a big difference, especially in today’s housing market. It may help you afford a larger home than you could on your own.

- Built-In Childcare: Having grandparents in the home could also save you money on childcare. They can help watch your kids while you’re at work, which means you can save on daycare costs too.

Beyond just the financial reasons, buying a multi-generational home has other advantages. The Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) highlights some of the most popular, including:

- Easier To Care for Aging Parents: It’s more convenient to take care of someone when you live with them. Also, your elderly parents may very well be happier and healthier, thanks to more social interaction and a feeling of connectedness.

- Spending More Time Together: Once you live together, you get to spend more time and create even more lasting memories with your loved ones.

The Mortgage Reports sums it up this way:

“Buying a house with your parents can be a great way to ease caregiving, support young children, or simply bring loved ones closer together. And considering the steep rise in home prices over the last few years, it can make homeownership a lot more affordable.”

How a Real Estate Agent Can Help

If you’re in the Sandwich Generation and thinking about buying a multi-generational home, working with a local real estate agent is essential. Finding a home that works for so many people can be tricky. An agent will use their expertise to help you find one that meets the needs of, and has enough space for, everyone who’s going to live there.

Bottom Line

Being a part of the Sandwich Generation comes with its challenges – but it also might come with one truly great perk. If you’re looking to buy a home, your caregiving situation can actually make it a bit easier for you to afford a home. To learn more, let’s connect.

Should You Rent Out or Sell Your House?

Figuring out what to do with your house when you’re ready to move can be a big decision. Should you sell it and use the money for your next adventure, or keep it as a rental to build long-term wealth?

It’s a question many homeowners face, and the answer isn’t always straightforward. Whether you’re curious about the potential income from renting or worried about the responsibilities of being a landlord, there’s a lot to consider.

Let’s walk through some key questions to ask to help you make the best decision for your situation.

Is Your House a Good Fit for Renting?

Even if you’re interested in becoming a landlord, your current house might not be ideal for renting. Maybe you’re moving far away, so keeping up with the ongoing maintenance would be a hassle, the neighborhood isn’t great for rentals, or the house needs significant repairs before you could rent it out.

If any of this sounds like it might apply, selling might be your best option.

Are You Ready for the Realities of Being a Landlord?

Managing a rental property isn’t just about collecting rent checks. It’s a time-consuming and sometimes challenging job.

For example, you may get calls from tenants at all hours of the day with maintenance requests. Or you may find a tenant causes damage you have to repair before the next lease starts. You may even have to deal with people falling behind on payments or breaking their lease early. Investopedia highlights:

“It isn’t difficult to find horror stories of landlords troubled with more headaches than profits. Before deciding to rent, consider talking to other landlords and doing a detailed cost analysis. You might find that selling your home is a better financial decision and less stressful.”

Do You Have a Good Understanding of What It’ll Cost?

If you’re thinking about renting out your home primarily to generate extra income, remember that there are additional costs you’ll want to plan for. As an article from Bankrate explains:

- Mortgage and Property Taxes: You still need to pay these expenses, even if the rent doesn’t cover all of it.

- Insurance: Landlord insurance costs about 25% more than regular home insurance, and it’s necessary to cover damages and injuries.

- Maintenance and Repairs: Plan to spend at least 1% of the home’s value annually, more if the home is older.

- Finding a Tenant: This involves advertising costs and potentially paying for background checks.

- Vacancies: If the property sits empty between tenants, you’ll lose rental income.

- Management and HOA Fees: A property manager can ease the burden, but typically charges about 10% of the rent. HOA fees are an additional cost too, if applicable.

Bottom Line

To sum it all up, selling or renting out your home is a personal decision that depends on your circumstances. Whatever you decide, taking the time to evaluate your options will help you make the best choice for your future.

Make sure to weigh the pros and cons carefully and consult with professionals so you feel supported and informed as you make your decision. That’s what we’re here for.

The Biggest Mistakes Sellers Are Making Right Now

The housing market is going through a transition. Higher mortgage rates are causing more moderate buyer activity at the same time the supply of homes for sale is growing.

And if you aren’t working with an agent, you may not realize that. Here’s the downside. If you’re not informed, you can’t adjust your strategy or expectations to today’s market. And that can lead to a number of costly mistakes.

Here’s a look at some of the most common ones – and how an agent will help you avoid them when you sell.

1. Overpricing Your House

Many sellers set their asking price too high and that’s why there’s an uptick in homes with price reductions today. An unrealistic price will deter potential buyers, cause an appraisal issue, or lead to your house sitting on the market longer. An article from the National Association of Realtors (NAR) explains:

“Some sellers are pricing their homes higher than ever just because they can, but this may drive away serious buyers and result in unapproved appraisals . . .”

To avoid falling into this trap, partner with a pro. An agent uses recent sales of similar homes, the condition of your house, local market trends, and so much more to find the price that’ll attract more buyers and open the door for multiple offers and a faster sale.

2. Skipping the Small Stuff

You may try to skip important repairs, thinking you can pass the task on to your buyer. But visible issues (even if they’re small) can turn off potential buyers and result in lower offers or demands for concessions. As Money Talks News says:

“Home shoppers like to turn on lights, flush toilets and run the water. If these basic things don’t work, they may assume you’ve skipped other maintenance. Homes that appear neglected aren’t likely to fetch top price.”

If you want to get your house ready to sell, the best place to turn to for advice is your agent. They’ll be able to do a walk-through with you and point out anything you’ll need to tackle before the photographer comes in.

3. Not Looking at Things Objectively

Buyers today are feeling the pinch of high home prices and mortgage rates. With affordability that tight, they may come in with an offer that’s lower than you’d want to see – especially if you didn’t stage, price, or market the house well.

It’s important you don’t take this personally. Getting overly emotional can put the sale at risk. As an article from Ramsey Solutions says:

“Remember, a buyer’s offer is not a reflection of their opinion of your home or your housekeeping abilities. . . The sale of your home is strictly a business transaction. If they start out with a low offer, don’t take it personally and get emotional. Instead, channel that energy toward negotiating. Work with your agent and make a counteroffer.”

4. Being Unwilling To Negotiate

The supply of homes for sale has grown. That means buyers have more options, and with that comes more negotiation power. As a seller, you may see more buyers getting an inspection, requesting repairs, or asking for help with closing costs today. You need to be prepared to have those conversations. As U.S. News Real Estate explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . the only way to come to a successful deal is to make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

An agent will walk you through what levers you may want to pull based on your own goals, budget, and timeframe.

5. Not Using a Real Estate Agent

Notice anything? For each of these mistakes, partnering with an agent helps prevent them from happening in the first place. That makes trying to sell your house without an agent’s help the biggest mistake of all.

Real estate agents have experience and expertise in pricing, marketing, negotiating, and more. That knowledge streamlines the selling process and usually results in drumming up more interest and ultimately can get you a higher final price.

Bottom Line

If you want to avoid making mistakes like these, let’s connect to make sure you’re set up for success.

Are Home Prices Going To Come Down?

Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking at what a correction means.

Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking at what a correction means.

Here’s what Danielle Hale, Chief Economist at Realtor.com, says:

“In stock market terms, a correction is generally referred to as a 10 to 20% drop in prices . . . We don’t have the same established definitions in the housing market.”

In the context of today’s housing market, it doesn’t mean home prices are going to fall dramatically. It only means prices, which have been increasing rapidly over the last couple years, are normalizing a bit. In other words, they’re now growing at a slower pace. Prices vary a lot by local market, but rest assured, a big drop off isn’t what’s happening at a national level.

The Real Estate Market Is Normalizing

From 2020 to 2022, home prices skyrocketed. That rapid increase was due to high demand, low interest rates, and a shortage of homes for sale. But, that kind of aggressive growth couldn’t continue forever.

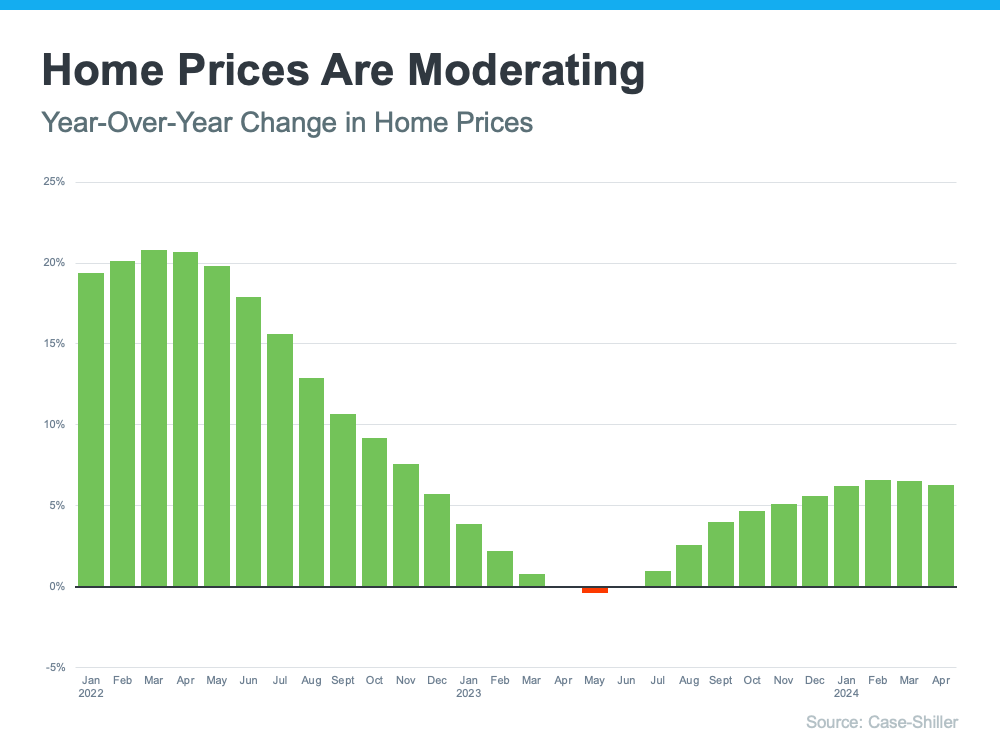

Today, price growth has started to slow down, which is a sign the market is beginning to normalize. The most recent data from Case-Shiller shows that after being basically flat for a couple of months last year, prices are going up at a national level – just not as quickly as before (see graph below):

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

Of course, that’s what’s happening now, but you may be wondering what’s next for prices. Marco Santarelli, the Founder of Norada Real Estate Investments, says:

“Expert forecasts lean towards a moderation in home price growth over the next five years. This translates to a slower and more sustainable pace of appreciation compared to the breakneck speed witnessed in recent years, rather than a freefall in prices.”

It’s all about supply and demand. Increasing inventory plus limited buyer demand, due to relatively high mortgage rates, will continue to ease some of the upward pressure on prices.

What This Means for You

If you’re thinking about buying a home, slowing price growth is welcome news. Skyrocketing home prices during the pandemic left many would-be homebuyers feeling priced-out.

While it’s still a good thing to know the value of the home you buy will likely continue to go up once you own it, slowing price gains are making things feel more manageable. Odeta Kushi, Deputy Chief Economist at First American, says:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help — so the dream of homeownership isn’t boarded up just yet.”

Bottom Line

At the national level, home prices are not going down. And most experts forecast they’ll continue growing moderately moving forward. But prices vary a lot by local market. That’s where a trusted real estate agent comes into play. If you have questions about what’s happening with prices in our area, reach out.

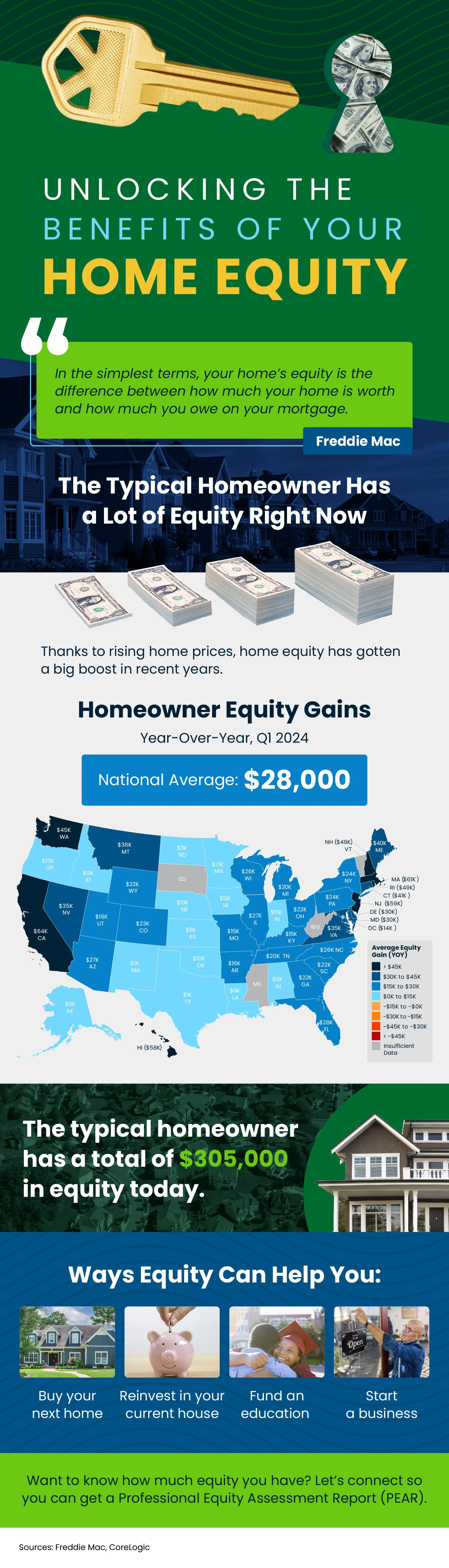

Unlocking the Benefits of Your Home’s Equity

Equity is the difference between what your house is worth and what you still owe on your mortgage. The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity. Want to know how much equity you have? Let’s connect so you can get a Professional Equity Assessment Report (PEAR).

How the Economy Impacts Mortgage Rates

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what’s ahead.

One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t directly control mortgage rates, they do control the Federal Funds Rate.

The relationship between the two is why people have been watching closely to see when the Fed might lower the Federal Funds Rate. Whenever they do, that’ll put downward pressure on mortgage rates. The Fed meets next week, and three of the most important metrics they’ll look at as they make their decision are:

- The Rate of Inflation

- How Many Jobs the Economy Is Adding

- The Unemployment Rate

Here’s the latest data on all three.

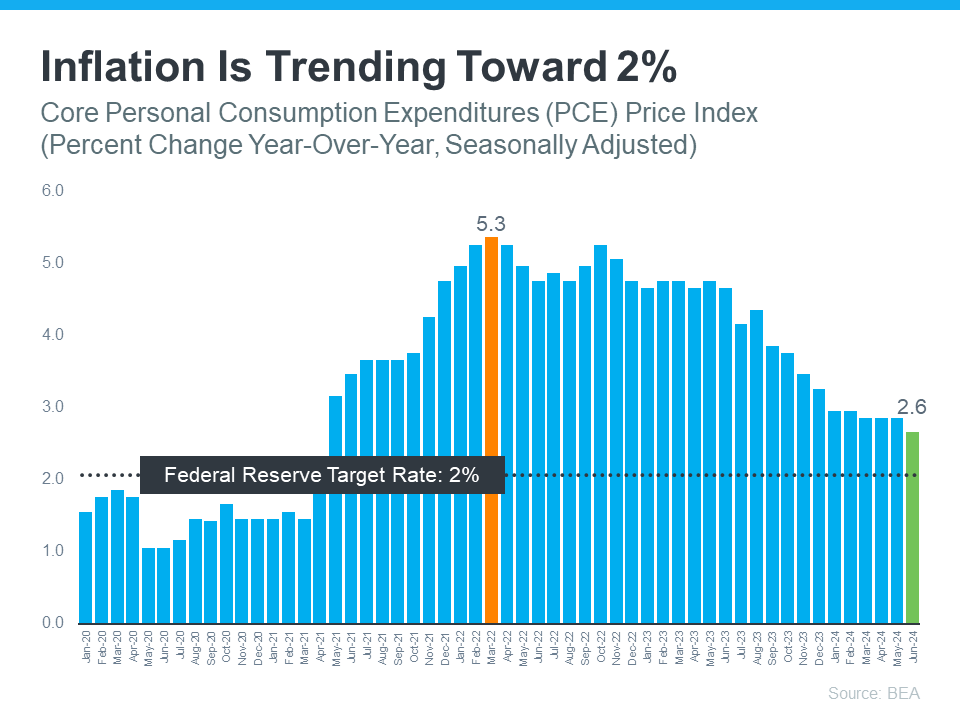

1. The Rate of Inflation

You’ve probably heard a lot about inflation over the past year or two – and you’ve likely felt it whenever you’ve gone to buy just about anything. That’s because high inflation means prices have been going up quickly.

The Fed has stated its goal is to get the rate of inflation back down to 2%. Right now, it’s still higher than that, but moving in the right direction (see graph below):

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding

The Fed is also watching how many new jobs are created each month. They want to see job growth slow down consistently before taking any action on the Federal Funds Rate. If fewer jobs are created, it means the economy is still strong but cooling a bit – which is their goal. That appears to be exactly what’s happening now. Inman says:

“. . . the Bureau of Labor Statistics reported that employers added fewer jobs in April and May than previously thought and that hiring by private companies was sluggish in June.”

So, while employers are still adding jobs, they’re not adding as many as before. That’s an indicator the economy is slowing down after being overheated for quite some time. This is an encouraging trend for the Fed to see.

3. The Unemployment Rate

The unemployment rate is the percentage of people who want to work but can’t find jobs. So, a low rate means a lot of Americans are employed. That’s a good thing for many people.

But it can also lead to higher inflation because more people working means more spending – which drives up prices. Right now, the unemployment rate is low, but it’s been rising slowly over the past few months (see graph below):

What Does This Mean Moving Forward?

While mortgage rates are going to continue to be volatile in the days and months ahead, these are signs the economy is headed in the direction the Fed wants to see. But even with that, it’s unlikely they’ll cut the Federal Funds Rate when they meet next week. Jerome Powell, Chair of the Federal Reserve, recently said:

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

Basically, we’re seeing the first signs now, but they need more data and more time to feel confident that this is a consistent trend. Assuming that direction continues, according to the CME FedWatch Tool, experts say there’s a projected 96.1% chance the Fed will lower the Federal Funds Rate at their September meeting.

Remember, the Fed doesn’t directly set mortgage rates. It’s just that whenever they decide to cut the Federal Funds Rate, mortgage rates should respond.

Of course, the timing of when the Fed takes action could change because of new economic reports, world events, and other factors. That’s why it’s usually not a good idea to try to time the market.

Bottom Line

Recent economic data may signal that hope is on the horizon for mortgage rates. Let’s connect so you have an expert to keep you up to date on the latest trends and what they mean for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link