Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Builders Are Building Smaller Homes

There’s no arguing it, affordability is still tight. And if you’re trying to buy a home, that may mean you need to look at smaller houses to find one that’s still in your budget. But there is a silver lining: builders are focused on building these smaller homes right now and they’re offering incentives. And that can help give you more options that fit the bill.

Newly Built Homes Are Trending Smaller

During the pandemic, homebuyers wanted (and could afford) larger homes – and builders delivered. They focused on homes that were bigger, so people had more space for things like working from home, having a home gym, bonus rooms for virtual school, and more.

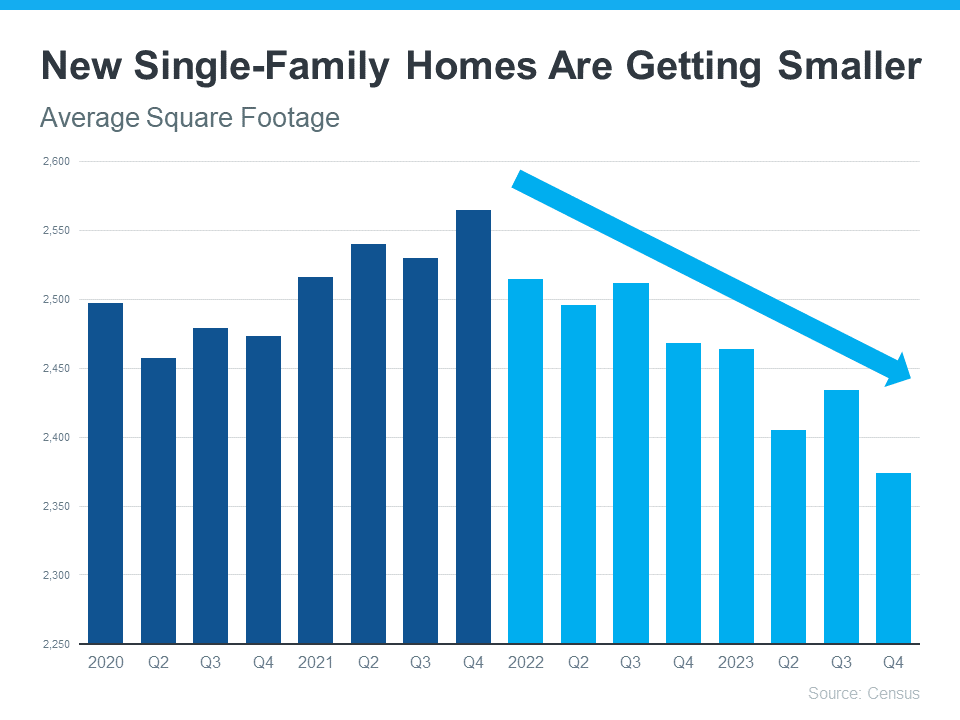

But with the affordability challenges buyers are facing today, builders are increasingly shifting their attention to bringing smaller single-family homes to the market. The graph below uses data from the Census to show how this trend has evolved over the last few years:

So, why the shift to less square footage? It’s simple. Builders want to build what they know will sell. Basically, they focus on where the demand is strongest. And once mortgage rates started climbing and consumers felt the challenges of affordability creeping in, it became clear there was (and is) a very real need for smaller homes. As the National Association of Home Builders (NAHB) explains:

“After a brief increase during the post-covid building boom, home size is trending lower and will likely continue to do so as housing affordability remains constrained.”

A recent article in the Real Deal says this about how this helps buyers:

“Even a slightly smaller home can be thousands of dollars cheaper — for both builders and buyers. . . In response to affordability challenges, major homebuilders are shifting priorities away from the big ticket homes and towards the cheaper set.”

What This Means for You

If you’re having a hard time finding something in your budget, it may help to look at smaller homes. And, if you consider new builds specifically, you may find a few other fringe benefits that can help on the affordability front – like price reductions or mortgage rate buy-downs. As NAHB says:

“More than one-third of builders cut home prices in 2023. NAHB expects builders to continue offering smaller homes and more affordable designs as housing affordability remains a barrier to homeownership.”

As Charlie Bilello, Chief Market Strategist, at Creative Planning, explains:

“Homebuilders are adapting to the lowest affordability on record by building smaller homes and offering more incentives/price cuts. The median square footage of a new single-family home in the US has moved down to its lowest level since 2010.”

If you explore these options, you’ll also get brand new everything, enjoy a house with fewer maintenance needs, and some of the latest features available. That’s worth looking into, right?

Bottom Line

Builders building smaller homes can give you more affordable options at a time when you may really need it. If you’re hoping to buy a home soon, let’s connect to look at what’s available in our area.

Should I Move with Today’s Mortgage Rates?

When mortgage rates spiked up over the last few years, some homeowners put their plans to move on pause. Maybe you did too because you didn’t want to sell and take on a higher mortgage rate for your next home. But is that still the right strategy for you?

In today’s market, data shows more homeowners are getting used to where rates are and thinking it may be time to move. As Mark Zandi, Chief Economist at Moody’s Analytics, explains:

“Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly coming to the realization that mortgage rates aren’t going back anywhere near the rate on their existing mortgage.”

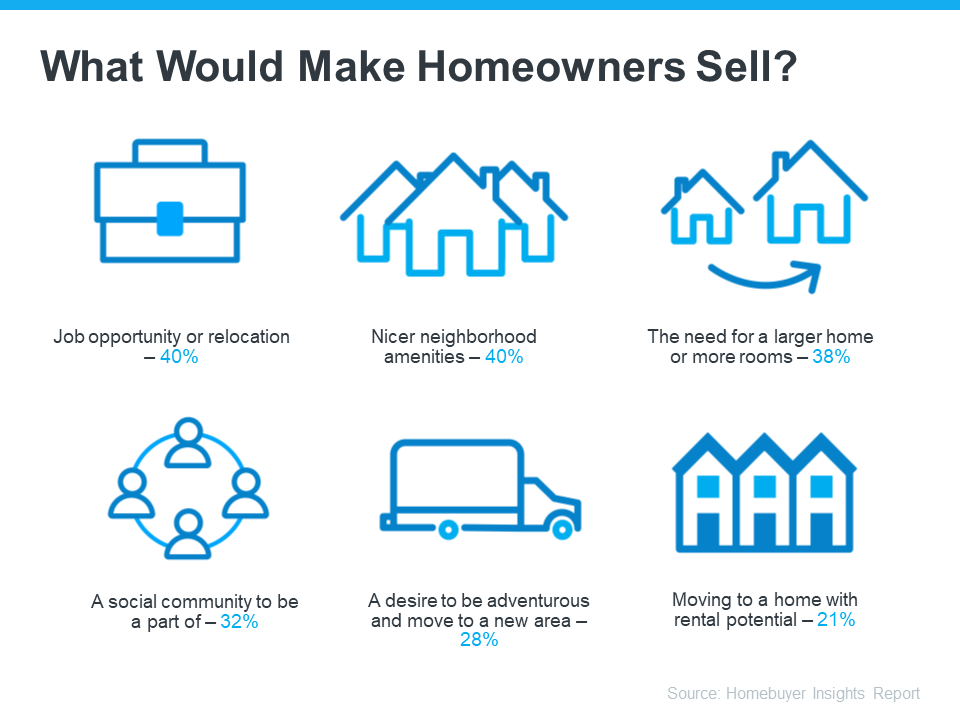

A recent study from Bank of America sheds light on some of the things homeowners say would make them sell, even with rates where they are right now (see visual below):

What Would Motivate You To Move?

Now that you know why other people would move, take a minute to think about what would make a move worth it for you. Is it time to take a chance and go for your dream job, even though it’s not local? Are you looking for a neighborhood that has more to offer and a close-knit sense of community? Maybe you just need more space, you’re looking for your next great adventure, or you want a house that opens up rental opportunities to pad your income.

And here’s something else to consider. Mortgage rates are still expected to go down over the course of the year. And once that happens, there’s going to be a big rush of buyers jumping back into the market. While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

So, does that mean it’s worth it to move now, even with rates where they are? The answer is: that it depends.

You’ll want to consider today’s mortgage rates, where they’re expected to go from here, and what would prompt you to want to make a change as you decide on your next steps. An expert can help with that.

Bottom Line

Other homeowners are getting used to rates and deciding to move. Let’s chat to go over what matters most to you and if it’s time for you to jump back into the market too.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

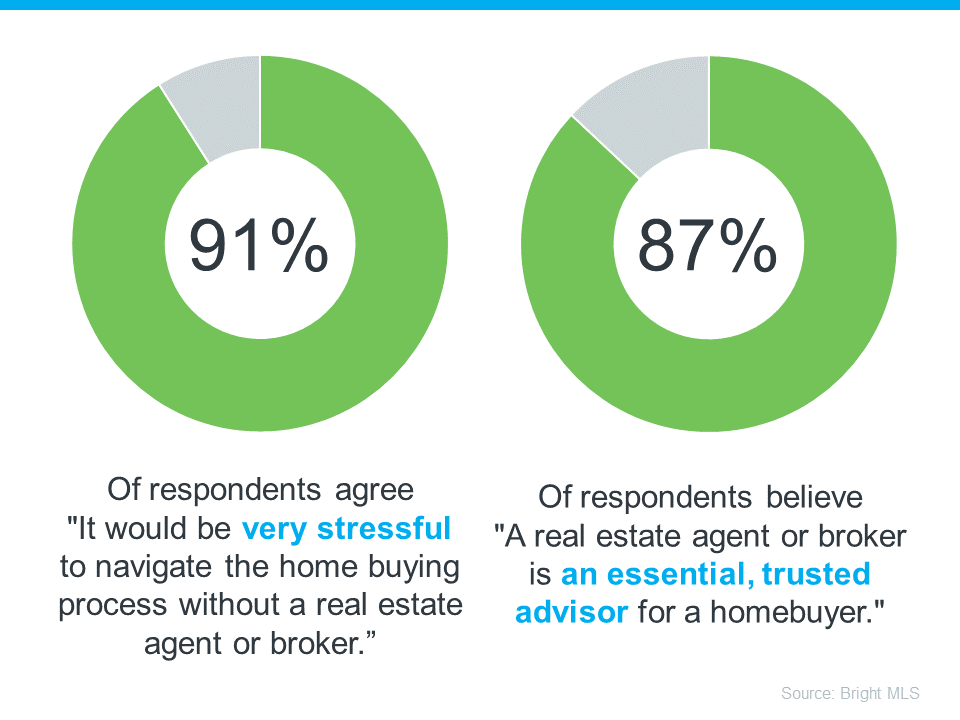

You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing. But here’s the thing you really need to know – expert advice from a trusted real estate agent is priceless, now more than ever. And here’s why.

A real estate agent does a lot more than you may realize.

Your agent is the person who will guide you through every step when buying a home and look out for your best interests along the way. They smooth out a complex process and take away the bulk of the stress of what’s likely your largest purchase ever. And that’s exactly what you want and deserve.

This is at least a part of the reason why a recent survey from Bright MLS found an overwhelming majority of people agree an agent is a key part of the homebuying process (see visual below):

To give you a better idea of just a few of the top ways agents add value, check out this list.

1. Deliver Industry Experience

The right agent – the professional – will coach you through everything from start to finish. With professional training and expertise, agents know the ins and outs of the buying process. And in today’s complex market, the way real estate transactions are executed is constantly changing, so having the best advice on your side is essential.

2. Provide Expert Local Knowledge

In a world that’s powered by data, a great agent can clarify what it all means, separate fact from fiction, and help you understand how current market trends apply to your unique search. From how quickly homes are selling to the latest listings you don’t want to miss, they can explain what’s happening in your specific local market so you can make a confident decision.

3. Explain Pricing and Market Value

Agents help you understand the latest pricing trends in your area. What’s a home valued at in your market? What should you think about when you’re making an offer? Is this a house that might have issues you can’t see on the surface? No one wants to overpay, so having an expert who really gets true market value for individual neighborhoods is priceless. An offer that’s both fair and competitive in today’s housing market is essential, and a local expert knows how to help you hit the mark.

4. Review Contracts and Fine Print

In a fast-moving and heavily regulated process, agents help you make sense of the necessary disclosures and documents, so you know what you’re signing. Having a professional that’s trained to explain the details could make or break your transaction, and is certainly something you don’t want to try to figure out on your own.

5. Bring Negotiation Expertise

From offer to counteroffer and inspection to closing, there are a lot of stakeholders involved in a real estate transaction. Having someone on your side who knows you and the process makes a world of difference. An agent will advocate for you as they work with each party. It’s a big deal, and you need a partner at every turn to land the best possible outcome.

Bottom Line

Real estate agents are specialists, educators, and negotiators. They adjust to market changes and keep you informed. And keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Expert advice from a trusted professional is priceless. Let’s connect today.

Don’t Let Your Student Loans Delay Your Homeownership Plans

If you have student loans and want to buy a home, you might have questions about how your debt affects your plans. Do you have to wait until you’ve paid off those loans before you can buy your first home? Or is it possible you could still qualify for a home loan even with that debt? Here’s a look at the latest information so you have the answers you need.

A Bankrate article explains:

“Roughly 60 percent of U.S. adults who have held student loan debt have put off making important financial decisions due to that debt . . . For Gen Z and millennial borrowers alone, that number rises to 70 percent.”

This includes one of the biggest financial decisions you’ll ever make, buying a home. But you should know, even with student loans, waiting to buy a home may not be necessary. While everyone’s situation is unique, your goal may be more within your reach than you realize. Here’s why.

Can You Qualify for a Home Loan if You Have Student Loans?

According to an annual report from the National Association of Realtors (NAR), 38% of first-time buyers had student loan debt and the typical amount was $30,000.

That means other people in a similar situation were able to qualify for and buy a home even though they also had student loans. And you may be able to do the same, especially if you have a steady source of income. As an article from Bankrate says:

“. . . you can have student loans and a mortgage at the same time. . . . If you have student loans and want a mortgage, there are multiple home loan programs you might qualify for . . .”

The key takeaway is, for many people, homeownership is achievable even with student loans.

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals. A trusted lender can walk you through your options based on your situation, and share what’s worked for other buyers.

Bottom Line

Lots of other people with student loan debt are able to buy their own homes. Talk to a lender to go over your options and see how close you are to reaching your goal.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize all at once. And the fear is that a sudden influx of homes for sale would have a big impact on housing. That’s because it would create a whole lot more competition for smaller homes and would throw off the balance of supply and demand, which ultimately would impact home prices.

But here’s the thing. There are a couple of faults in that logic. Let’s break them down and put your mind at ease.

Not All Baby Boomers Plan To Move

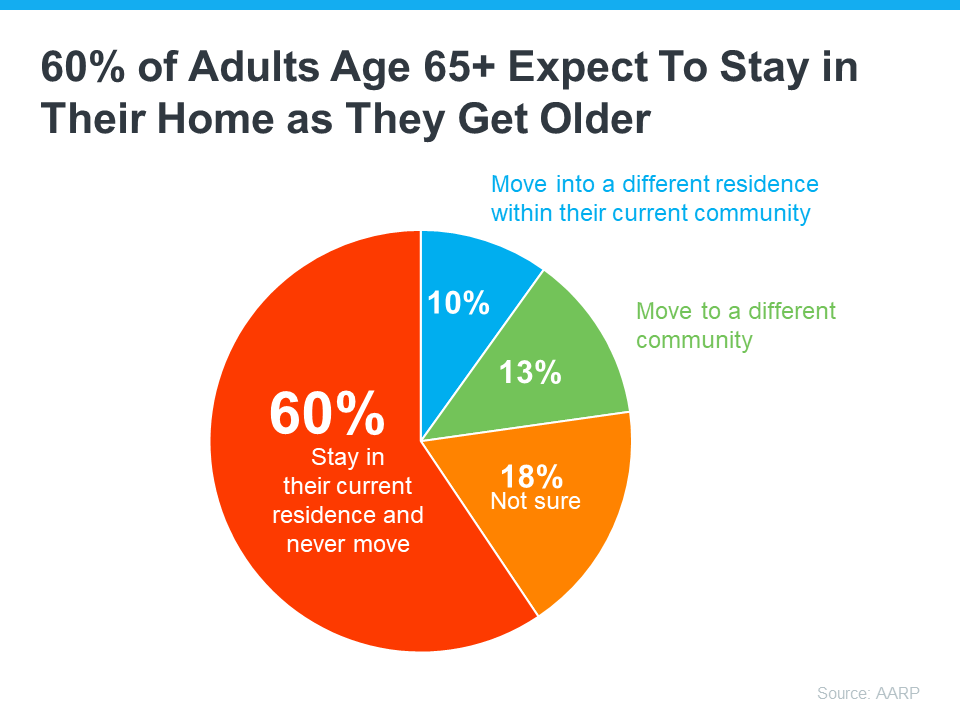

For starters, plenty of baby boomers don’t plan on moving at all. A study from the AARP says more than half of adults aged 65 and older want to stay in their homes and not move as they age (see graph below):

While it’s true circumstances may change and some people who don’t plan to move (the red in the chart above) may realize they need to down the road, the vast majority are counting on aging in place.

As for those who stay put, they’ll likely modify their homes as their needs change over time. And when updating their existing home won’t work, some will buy a second home and keep their original one as an investment to fuel generational wealth for their loved ones. As an article from Inman explains:

“Many boomers have no desire to retire fully and take up less space . . . Many will modify their current home, and the wealthiest will opt to have multiple homes.”

Even Those Who Do Move Won’t Do It All at Once

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time. Instead, it’ll happen slowly over many years. As Freddie Mac says:

“We forecast the ‘tsunami’ will be more like a tide, bringing a gradual exit of 9.2 million Boomers by 2035 . . .”

As Mark Fleming, Chief Economist at First American, says:

“Demographics are never a tsunami. The baby boomer generation is almost two decades of births. That means they’re going to take about two decades to work their way through.”

Bottom Line

If you’re stressed about a Silver Tsunami shaking the housing market overnight, don’t be. Baby boomers will move slowly over a much longer period of time.

Newly Built Homes Could Be a Game Changer This Spring

Buying a home this spring? You’re probably navigating today’s affordability challenges and dealing with the limited number of homes for sale. But, what if there was a solution that could help with both?

If you’re having a hard time finding a home you love, and mortgage rates are putting pressure on your budget, it may be time to look at newly built homes. Here’s why.

New Home Construction Is an Inventory Bright Spot

When looking for a home, you can choose between existing homes (those that are already built and previously owned) and newly constructed ones. While the number of existing homes for sale has increased this year, there are still fewer available than there were in more typical years in the housing market, like back in 2018 or 2019.

So, if you’re looking to expand your pool of options even more, turning to newly built homes can help. As Danielle Hale, Chief Economist at Realtor.com, explains:

“The shortage of existing homes For Sale has opened up the possibility of new-home construction to more buyers who may not have once considered it.”

And the good news is, there are more newly built homes to pick from right now. The graphs below use data from the Census to show how new home construction is ramping up in two key areas (see most recent spike in green):

Starts, or homes where builders just broke ground, have seen a big increase lately. And completions, homes that builders just finished, are also up significantly. So, if you want a new, move-in ready home or you want to get in early and customize your build along the way, you have more options right now.

Builders Are Offering Incentives To Help with Affordability

And to sweeten the pot, builders are offering things like mortgage rate buy-downs and other perks for homebuyers right now. This can help offset today’s affordability challenges while also getting you into your dream home. Mark Fleming, Chief Economist at First American, explains why you may find builders have more wiggle room to offer more for you than the typical homeowner:

“Builders aren’t rate locked-in. They would love to sell you the home because they’re not living in it. It costs money not to sell the home. And many of the public home builders have said in their earnings calls that they are not going to be pulling back on incentives, especially the mortgage rate buydown, so that will help the new-home market continue to perform well in the spring home-buying season.”

An article from HousingWire also says this about what builders are offering right now:

“. . . the use of sales incentives still shows some momentum as 60% of respondents reported using them, up from 58% in February. “

Just remember, buying from a builder is different from buying from a home seller, so it’s important to partner with a local real estate agent. Builder contracts can be complex. A trusted agent will be your advocate throughout the process.

They’ll be your go-to resource for advice on construction quality and builder reputation, reviewing and negotiating contracts to get you the best deal, helping you decide on which customizations and upgrades are most worthwhile, and a whole lot more.

Bottom Line

If you’re struggling to find a home to buy, or with today’s affordability challenges, let’s connect to see if newly built homes could be the solution you’re looking for.

Why Overpricing Your House Can Cost You

If you’re trying to sell your house, you may be looking at this spring season as the sweet spot – and you’re not wrong. We’re still in a seller’s market because there are so few homes for sale right now. And historically, this is the time of year when more buyers move, and competition ticks up. That makes this an exciting time to put up that for sale sign.

But while conditions are great for sellers like you, you’ll still want to be strategic when it comes time to set your asking price. That’s because pricing your house too high may actually cost you in the long run.

The Downside of Overpricing Your House

The asking price for your house sends a message to potential buyers. From the moment they see your listing, the price and the photos are what’s going to make the biggest first impression. And, if it’s priced too high, you may turn people away. As an article from U.S. News Real Estate says:

“Even in a hot market where there are more buyers than houses available for sale, buyers aren’t going to pay attention to a home with an inflated asking price.”

That’s because no homebuyer wants to pay more than they have to, especially not today. Many are already feeling the pinch on their budget due to ongoing home price appreciation and today’s mortgage rates. And if they think your house is overpriced, they may write it off without even stepping foot in the front door, or simply won’t make an offer if they think it’s priced too high.

If that happens, it’s going to take longer to sell. And ideally you don’t want to have to think about doing a price drop to try to re-ignite interest in your house. Why? Some buyers will see the price cut as a red flag and wonder why the price was reduced, or they’ll think something is wrong with the house the longer it sits. As an article from Forbes explains:

“It’s not only the price of an overpriced home that turns buyers off. There’s also another negative component that kicks in. . . . if your listing just sits there and accumulates days on the market, it will not be a good look. . . . buyers won’t necessarily ask anyone what’s wrong with the home. They’ll just assume that something is indeed wrong, and will skip over the property and view more recent listings.”

Your Agent’s Role in Setting the Right Price

Instead, pricing it at or just below current market value from the start is a much better strategy. So how do you find that ideal asking price? You lean on the pros. Only an agent has the expertise needed to research and figure out the current market value for your home.

They’ll factor in the condition of your house, any upgrades you’ve made, and what other houses like yours are selling for in your area. And they’ll use all of that information to find that target number. The right price will bring in more buyers and make it more likely you’ll see multiple offers too. Plus, when homes are priced right, they still tend to sell quickly.

Bottom Line

Even though you want to bring in top dollar when you sell, setting the asking price too high may deter buyers and slow down the sales process.

Let’s connect to find the right price for your house, so we can maximize your profit and still draw in eager buyers willing to make competitive offers.

The Best Week To List Your House Is Almost Here

Are you thinking about making a move? If so, now may be the perfect time to start the process. That’s because experts say the best week to list your house is just around the corner.

A recent Realtor.com study looked at housing market trends over the past several years (with the exception of 2020, since it was an unusual year), and found the best week to put your house on the market this year is April 14-20:

“Every year, one week stands out from the rest as that perfect stretch of time when it’s great to be a home seller. This year, the week of April 14–20 is the best time to sell—that is, if sellers want to see lots of interest in their homes, sell quickly, and pocket some extra cash, according to Realtor.com® data.”

Here’s why this matters for you. While the spring market is a great time to sell no matter the week, this may be the peak sweet spot. And if you’ve been putting your plans on the back burner and waiting for the right time to act, this could be the nudge you need to make your move happen. As Hannah Jones, Senior Economic Research Analyst at Realtor.com explains:

“The third week of April brings the best combination of housing market factors for sellers. The best week offers higher buyer demand, lower competition [from other sellers], and fewer price reductions than the typical week of the year.”

But, if you want to get in on the action, you’ll need to move quickly and lean on the pros. Your local real estate agent is the perfect go-to when it comes to figuring out a plan to prep your house and get it on the market.

They’ll be able to offer advice to balance your target listing date with what you need to do from a repair and renovation standpoint. And they can walk you through exactly how to prioritize your list so you know what to tackle first.

For example, if your house is already in good shape, you’ll be able to really focus in on the smaller things that are easy to do and make a big impact. As an article from Investopedia says:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Here are some specific examples from that article:

Just remember, even if you’re not ready to list within the next couple of weeks, that’s okay. The window of opportunity doesn’t close when this week ends. Spring is the peak homebuying season and it’s still a seller’s market, so you’ll be in the driver’s seat all season long.

Bottom Line

Ready to get the ball rolling? Let’s connect and schedule a time to go over your next steps.

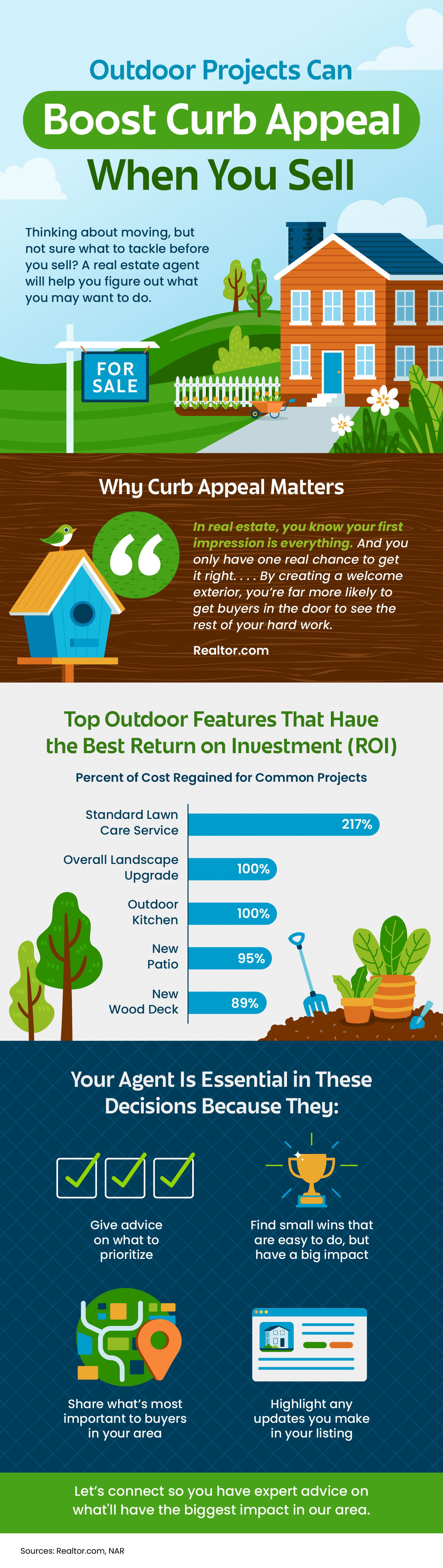

Outdoor Projects Can Boost Curb Appeal When You Sell

Some Highlights

- In real estate, a good first impression is key. If the outside of a house looks welcoming, more people will want to come in and see it.

- Your agent helps you by giving advice on what you may want to prioritize, finding easy fixes that make a big difference, knowing what buyers in your area like, and showing off your updates in your listing.

- Let’s connect so you have expert advice on what’ll have the biggest impact in our area.

Is It Easier To Find a Home To Buy Now?

One of the biggest hurdles buyers have faced over the past few years has been a lack of homes available for sale. But that’s starting to change.

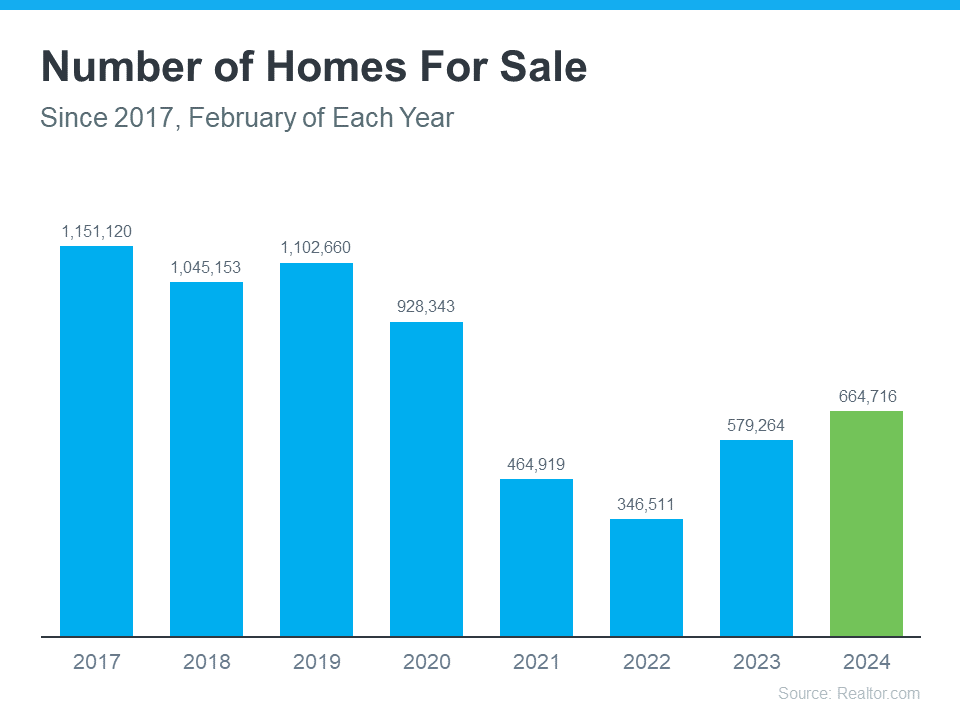

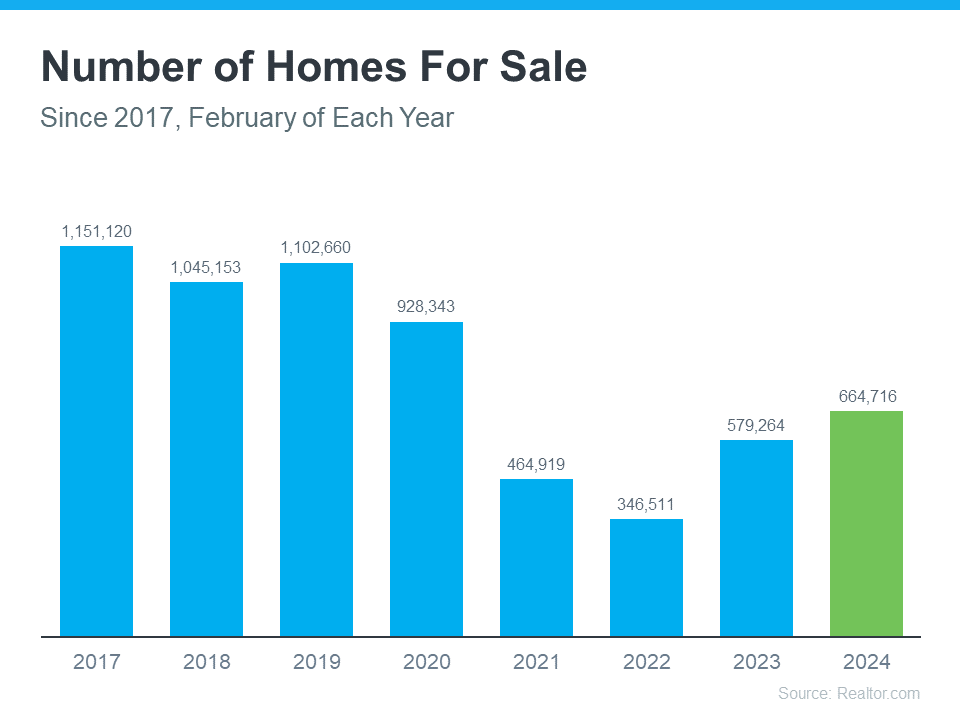

The graph below uses the latest data from Realtor.com to show there are more homes on the market in 2024 than there have been in any of the past several years (2021-2023):

Does That Mean Finding a Home Is Easier?

The answer is yes, and no. As an article from Realtor.com says:

“There were nearly 15% more homes for sale in February than a year earlier . . . That alone could jolt the housing market a bit if more “For Sale” signs continue to appear. However, the nation is still suffering from a housing shortage even with all of that new inventory.”

Context is important. On the one hand, inventory is up over the past few years. That means you’ll likely have more options to choose from as you search for your next home.

But, at the same time, the graph above also shows there are still significantly fewer homes for sale than there would usually be in a more normal, pre-pandemic market. And that deficit isn’t going to be reversed overnight.

What Does This Mean for You?

You might find a few more choices now than in recent years, but you shouldn’t expect a ton of options.

To help you explore the growing list of choices you have now, team up with a local real estate agent you trust. They can really help you understand the inventory situation where you want to buy. That’s because real estate is local. An experienced agent can share some smart tips they’ve used to help other buyers in your area deal with ongoing low housing supply.

Bottom Line

If you’re thinking about buying a home, let’s team up. That way, you’ll be up to date on everything that could affect your move, including how many homes are for sale right now.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link